On nearly all North American banks’ websites, one can find a section titled “Diversity and Inclusion”. In recent decades, global banks (especially in North America) have publicly announced their various initiatives related to improving and supporting diversity and inclusion in the financial services industry.

It has become standard for banks in virtually every region of the world to highlight this relatively new policy, one that aims to ensure that people of all genders and backgrounds have an equal chance of being both employed and able to progress through their organizations fairly.

Indeed, the top banks worldwide have made significant progress in improving their firms’ diversity and inclusion standards. However, there is still much work to improve.

How are Canadian banks doing?

According to Bloomberg, at Canada’s Big 6, 10 percent of senior executive roles and eight percent of non-executive board positions are held by visible minorities, as of June 2020. Of 188 top executive and board positions at those eight companies, only one position is occupied by an African American.

Being ranked one of the most diverse countries globally, Canada has seen its banking industry lag behind the nation’s improvements. It should be noted that banking executives have taken note of their lagging statistics and have implemented many best practices to increase their diversity and inclusion standards.

At most Canadian banks, more than a third of their staff are non-white. Canadian banking executives face enormous public pressure to do something about the glass ceiling that has historically faced those employees.

The May 2020 killing of George Floyd in Minneapolis sparked protests worldwide and throughout Canada — raising many concerns that brought diversity and inclusion standards and statistics to the top of mind of many executives. Notably, many executives stepped up to get the ball rolling.

Wes Hall, an experienced African American Canadian executive at Kingsdale Advisors, approached CIBC CEO Victor Dodig to launch the BlackNorth Initiative. This initiative aims to increase the number of African American representation on boards and executive roles across Canada.

Set Objectives for Diversity in the Banking Industry

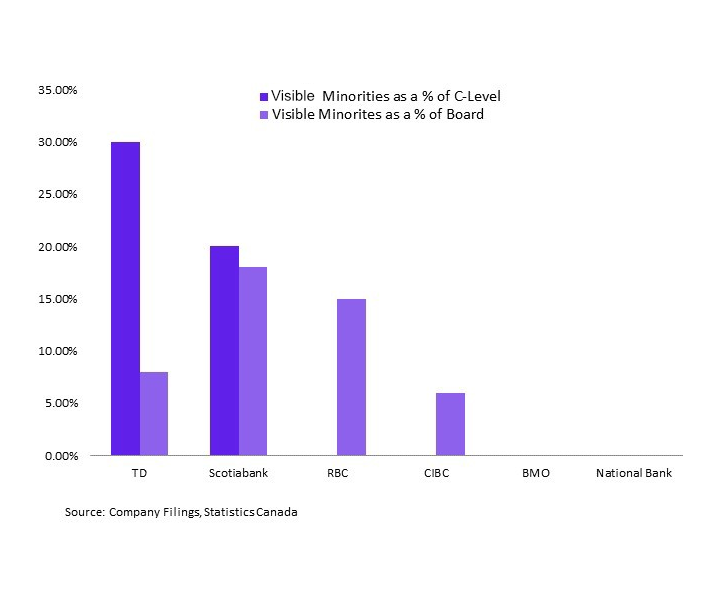

Other banks, such as RBC, BMO, and ScotiaBank have all assumed a long-list of initiatives to improve the diverse representation in their offices. RBC CEO, David McKay, stated “You’ve got to set objectives and measure what the important milestones are towards that objective and what needs to get done, and know quickly when you’re not on the path to success. If you keep doing the same old, same old, then we’ll get the same outcome. We have to approach this differently.” See the graph below for each Canadian bank’s C-Level and Board of Directors’ current diversity representation.

What about U.S. banks?

The U.S. banks report similar results to that of Canadian banks. Data released from the U.S. House Committee on Financial Services reveals diversity and inclusion in the finance industry lag. In August of 2019, several members of the United States Congress requested 5-years worth of hiring data from eight megabanks: Bank of America Corporation, Bank of New York Mellon Corporation, Citigroup Inc., Goldman Sachs Group, Inc., JP Morgan Chase & Co., Morgan Stanley, State Street Corporation, and Wells Fargo & Company. The diversity and inclusion data received was from 2015 until the present day.

The findings revealed process and improvement from data compared to the previous decade, yet it also emphasized that there is significant process to be made. Some of the findings include:

- Bank’s board of directors are still mainly comprised of white males

- Bank’s senior leadership is mostly comprised of white males

- Not one single U.S. bank’s Chief Diversity Officer reported directly to the CEO

- Diversity metrics were not tied to compensation

- Only half of the U.S. banks tied diversity metrics to performance

Like most challenges faced by businesses, the solution takes many years to unfold fully. U.S. banks have also done notable work to improve their diversity standards. For example, Goldman Sachs CEO David Solomon announced at the 2019 Davos conference that Goldman Sachs would no longer complete a company initial public offering without representing at least one female board member.

How are global banks improving their diversity standards?

Across all major banks, both Canadian and U.S. based, there seem to be many common initiatives underway to increase long-term diversity and inclusion metrics. Examples of initiatives to improve diversity and inclusion in financial services:

- Recruiting From Diverse Universities: Historically, the vast majority of U.S. and Canadian banks recruited from target schools. These target schools mainly consisted of non-diverse wealth students and created financial barriers for diverse students to access the same education level. This list of target schools includes Ivy League universities and institutions like New York University, Duke University, and University of Toronto, etc. Now, namely U.S. banks, have began seeking partnerships with historically diverse colleges and universities to increase the talent pool’s diversity. Many Canadian and U.S. banks have identified that exploring outside of common target schools is how the pipeline can become more diverse.

- Investing in Minority-Based Leadership Programs for Diverse Talent: Both Canadian and U.S. banks have significantly increased their investment in facilitating minority-based leadership and education programs. These programs include educational conferences and mentorship engagement with students, internships, and on-site employee initiatives. By facilitating such programs, U.S. and Canadian banks are hoping to increase the competitiveness of diverse talent by making education-based opportunities more accessible.