The European Sustainability Reporting Standards (ESRS) are a set of in-depth regulations introduced by the European Union under the Corporate Sustainability Reporting Directive (CSRD). These standards go far beyond the earlier Non-Financial Reporting Directive (NFRD), ensuring a more rigorous framework for sustainability reporting. ESRS cover environmental, social, & governance (ESG) factors, demanding companies to provide detailed information about their sustainability practices. This move is part of the EU’s larger agenda to tie in sustainability deeply into corporate operations.

Who Does ESRS Apply To?

The ESRS officially became law on 31st July 2023, and the implementation phase starts on 1st January 2024, rolling out gradually until 2028. The first companies to comply will be large public-interest entities (PIEs), which include major listed companies, banks, & insurance firms. Additionally, non-European companies that generate significant revenue within the EU will also be subject to these standards. The regulations aim to bring transparency and uniformity, which is increasingly vital for investors, regulatory bodies, and the public.

The standards are designed for:

- Large Public-Interest Entities (PIEs): Publicly listed companies, banks, & insurance firms are the primary focus, determined by factors such as employee count, revenue, & balance sheet size.

- Non-European Companies: Any non-EU entity generating significant revenue in Europe is also required to comply with ESRS.

- Listed Small and Medium-Sized Enterprises (SMEs): Although the primary target is large corporations, listed SMEs are included but may face lighter requirements.

- Other Entities: Businesses with a notable environmental, economic, or social impact, even if not publicly listed, may also need to adhere to ESRS.

- Key Requirements for Companies – Who has to comply with CSRD?: The CSRD mandates companies based in EU or a turnover of above €150 million in the EU.

Data Collection & Reporting Processes

To fulfil their CSRD obligations, companies must follow specific guidelines from ESRS, notably ESRS S1, which focuses on the company’s own workforce. The standard outlines 17 reporting requirements, ranging from policies, engagement processes, & metrics related to the workforce. These measures aim to enhance transparency and ensure a consistent, thorough reporting approach.

- S1-1: Policies related to their own workforce.

- S1-2: Processes for engaging with own workers and workers’ representatives about impacts.

- S1-3: Processes to remediate negative impacts and channels for own workers to raise concerns.

- S1-4: Taking action on material impacts on own workforce, and approaches to mitigating material risks and pursuing material opportunities related to own workforce, & effectiveness.

- S1-5: Targets related to managing material negative impacts, advancing positive impacts, & managing material risks and opportunities.

- S1-6: Characteristics of the undertaking’s employees.

- S1-7: Characteristics of non-employee workers in the undertaking’s own workforce.

- S1-8: Collective bargaining coverage and social dialogue.

- S1-9: Diversity metrics.

- S1-10: Adequate wages.

- S1-11: Social protection.

- S1-12: Persons with disabilities.

- S1-13: Training and skills development metrics.

- S1-14: Health and safety metrics.

- S1-15: Work-life balance metrics.

- S1-16: Compensation metrics (pay gap and total compensation).

- S1-17: Incidents, complaints, & severe human rights impacts.

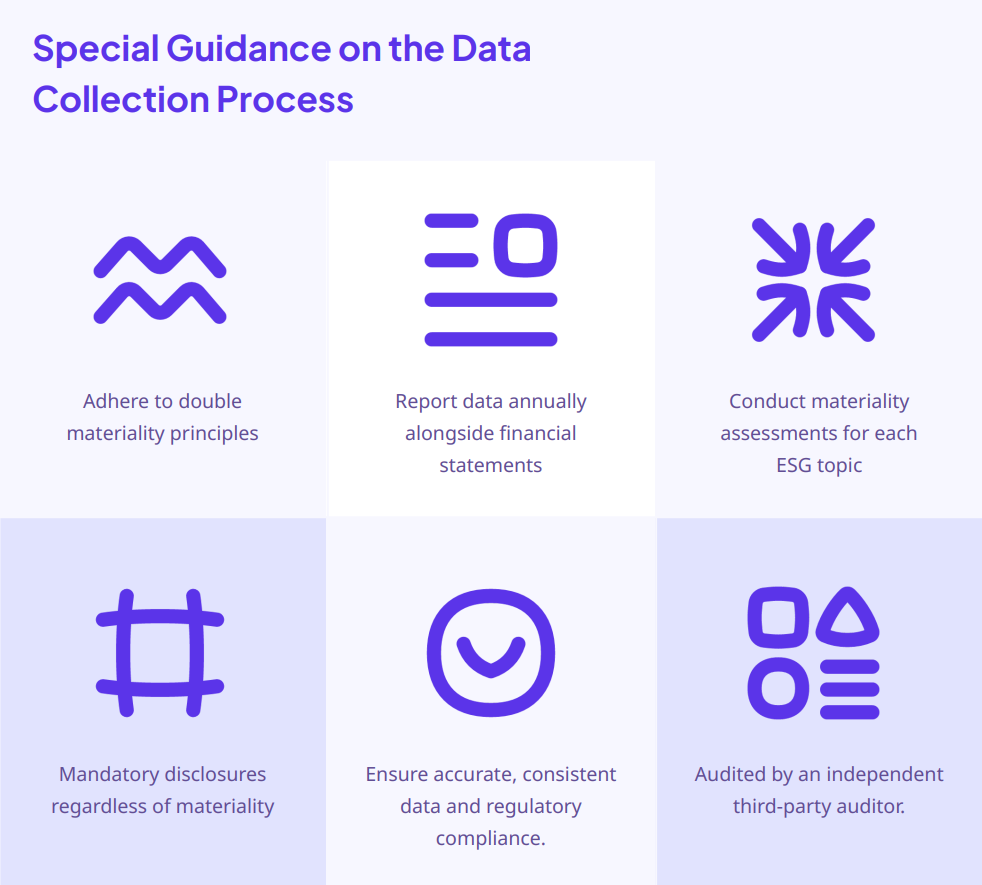

Other mandatory information includes topics covered under ESRS 2 for general disclosures. This lists mandatory disclosures for in-scope companies, irrespective of materiality as well as sustainability-related performance integration in incentive schemes, due diligence processes, & materiality assessment process.

Reporting Best Practices

Data collected under ESRS must be reported annually, alongside financial statements. The standards require disclosure on all material ESG topics, regardless of materiality, & an independent third-party auditor must review these reports.

Best practices for data collection include conducting thorough materiality assessments, ensuring inter-departmental collaboration for accuracy, & implementing consistent data collection methods. These practices improve data accuracy and relevance, minimize mismanagement risks, and enhance overall data quality.

Potential Risks and Challenges

All forms of data collection come with risk. This includes the following potential areas of concern:

- Incomplete or inaccurate data collection

- Misinterpreting materiality assessments

- Non-compliance with due diligence and reporting boundaries

- Privacy and data security concerns

Consequences of Non-Compliance

Failing to comply with the CSRD can lead to serious consequences, including financial penalties, reputational damage, legal and regulatory repercussions. Each EU member state will set the penalty and define the limits of the sanctions within their jurisdiction. Companies that don’t comply with ESRS risk facing both regulatory and market backlash, which can negatively affect their bottom line.

How Diversio Can Assist

At Diversio, we are poised to help companies navigate these complex reporting requirements. Through secure data collection, in-depth data analysis, & a focus on diversity and inclusion, Diversio offers a comprehensive solution to help businesses comply with ESRS. Whether it’s developing accurate benchmarks or integrating diversity data into broader ESG frameworks, Diversio’s tools can help companies achieve compliance while fostering a more inclusive workplace.

About Diversio

Diversio has extensive experience working with organizations worldwide, offering insights and data assessments across 55+ countries in multiple languages. With proprietary benchmarking data and over 1,500+ tested solutions, the platform leverages data analytics & artificial intelligence (“AI”), to provide industry-specific solutions tailored to help organizations meet their ESG and diversity goals. Book a demo to find out more.

Download the full PDF resource to learn more about complying with the ESRS and how it can benefit your company’s sustainability efforts.