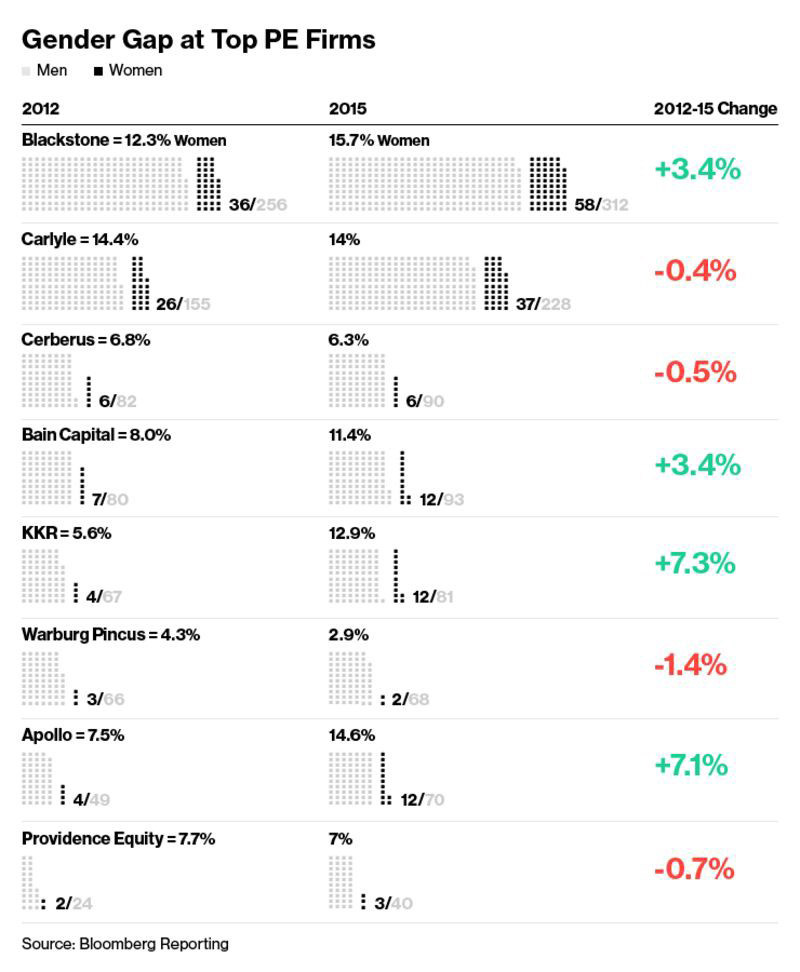

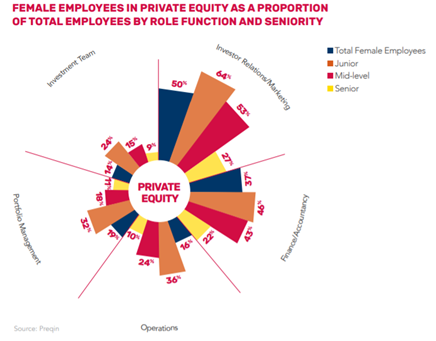

Historically, private equity has been predominantly male and rather lacking in diversity. Women hold just 10% of senior positions in private equity and venture capital firms globally. Despite some recent steps in the right direction, even firms who support diversity and inclusion initiatives are finding it difficult to attract new talent and retain it. Others don’t see the value in investing in D&I strategies at all.

Gender Gap at Top PR Firms

|

Blackstone

Carlyle

Cerberus

Bain Capital

|

KKR

Warburg Pincus

Apollo

Providence Equity

|

There are many systemic barriers to achieving an ethnic and gender-balanced workplace, and they cannot be removed all at once, but working towards such an environment has proven to help companies be more successful. Building a culture of inclusion is worthwhile and attainable, with a bit of planning and an open mind.

What’s Causing The Diversity Gap?

Private equity, by nature, is a long-haul game. It can take years to see a return on investments, and often requires investors to take control of acquisitions through time-consuming, hands-on work. Right away, this can be seen as a challenge by women considering the field — and rightly so. The vast majority of PE firms have no support systems in place for women, such as maternity leave, which makes achieving a work-life balance seem almost impossible. From a family planning perspective, this lack of accommodation that is standard in so many other sectors is a big turn-off.

For other minorities, such as those with different ethnicities, sexual orientations and identities, or religious backgrounds, this theme of inadequate support holds up. Many won’t consider applying to private equity firms because work environments are not inclusive — consciously or not. Promoting a safe space to share ideas and opinions is crucial, not only to guiding creative thinking and good decision-making, but to getting those thinkers on board in the first place.

Even with the right strategies in place, and an ideal workspace, yet another set of hurdles comes with hiring. A hiring panel might be all for a diverse team, but unconscious biases are prevalent in most cases, especially when executives are mostly white and male. It’s hard to recognize this bias in action, but there are actionable steps that can help eliminate it, and give diverse candidates a fighting chance.

Why should I care?

While it’s progressive and objectively the “right thing to do,” integrating an effective D&I strategy into your private equity firm is undoubtedly an investment in itself. Depending on how you want to go about it, there are varying amounts of time, effort, and money that have to be spent on such a complex and involved undertaking. Is it worth the investment?

Some Quick Facts About Diversity In Private Equity

· Diverse & inclusive groups make better decisions backed by facts more efficiently and with less cognitive bias

Different perspectives and approaches to problem-solving reduce “groupthink” and lead to more creative critical thinking. An inclusive culture increases transparency and participation, which leads to better decision making and ultimately better performance.

· McKinsey’s “Delivering Through Diversity” report found quantifiable links between diversity and profitability

Businesses in the top quartile for gender diversity at the executive level are 21% more likely to generate above average profits, and 27% more likely to have superior value creation, than those in the bottom quartile.

“If you exclude 50% of the talent pool, it’s no wonder you find yourself in a war for talent.”

— Theresa J. Whitmarsh, Executive Director of the Washington State Investment Board

Top quartile businesses for ethnic and cultural diversity at the executive level are 33% more likely to outperform on EBIT margin. Contrastingly, the bottom quartile companies were 29% less likely to achieve above-average profitability. And these stats make sense. Diverse environments show reduced conflict and more collaboration. They are also more attractive to high-performing individuals, and important for retaining existing talent.

· Limited Partners look for D&I metrics when making investment decisions.

65% of LPs say they value diversity, and many ask fund managers for D&I data in due diligence.

It’s also important to recognize the impact a comprehensive D&I strategy can have on public image, globally, and employee satisfaction. A good reputation in this regard makes a company more appealing to workers, customers, and the extended community.

These ideas are starting to gain traction across the investment industry. On October 1st, 2020, the Responsible Investment Association coordinated the Canadian Investor Statement on Diversity & Inclusion, which has been signed by institutional investors managing more than $2.3 trillion in assets. It recognizes the prevalence of inequities, and acknowledges a responsibility to eliminate them. Signatories will integrate D&I measures into their businesses and investment processes.

“A diverse mix of voices leads to better discussions, decisions, and outcomes for everyone”

— Sundar Pichai, CEO of Google

How Do I Improve My Private Equity Culture?

You’re not alone, and it’s not too late! There are many resources to help improve diversity and inclusivity in your PE firm, and one especially useful tool is a roadmap developed by the Institutional Limited Partners Association. It was made specifically with the private equity industry in mind, and outlines best practices that can be implemented to advance D&I efforts. The roadmap provides insight, tips, and tools in several areas:

- Demonstrating organizational support for D&I

- Attract and Promote Diverse talent

- Build and Sustain Inclusive Cultures

- Apply D&I to investment strategy

- Measure and benchmark D&I Progress

Other Resources

Diversio has teamed up with the ILPA, with unique technology that can help your business “Measure and benchmark D&I Progress” and ensure you’re on the right track.

To learn more about how you can make your workplace more inclusive, visit our website: www.diversio.com

References

[1]S. Q. W. Paul A. Gompers, “And the Children Shall Lead: Gender Diversity and Performance in Venture Capital,” Nation Bureau of Economic Research, Cambridge, 2017. https://www.nber.org/papers/w23454.pdf

[2]V. Robson, “The value of diversity,” Private Equity International, 4 October 2018. https://www.privateequityinternational.com/opex2018-the-value-of-diversity/